However the value of office supplies inventory is usually so low as to be immaterial to the overall value of the company and if the value is immaterial it can be easier to simply treat office supply purchases. Supplies can be considered a.

Stationery Is An Asset Or An Expense Online Accounting

Once supplies are used they are converted to an expense.

. Technically speaking unused office supplies are an asset and to the extent that they are expected to be used within a year they are considered to be a current asset. Office Supplies Low Poly. This allows you to depreciate them and thus deduct them on your business tax return.

Likewise the credit of office supplies in this journal entry represents the office supplies used during the period. The general rule is anything over 10000 in value should be capitalized as an asset and depreciated. Current assets are also termed liquid assets and examples of such are.

In general supplies are considered a current asset until the point at which theyre used. Clean Sweep Supply is a one-stop web resource for all organization and cleaning needs. Technically if you purchase any items such as the items below you should be categorizing them as an asset.

The Supplies on Hand asset account is classified within current assets since supplies are expected to be consumed within one year. Examples of Factory Supplies. Having worked with some of the sectors largest retailers on their most challenging projects we have developed a vast experience base to offer our clients.

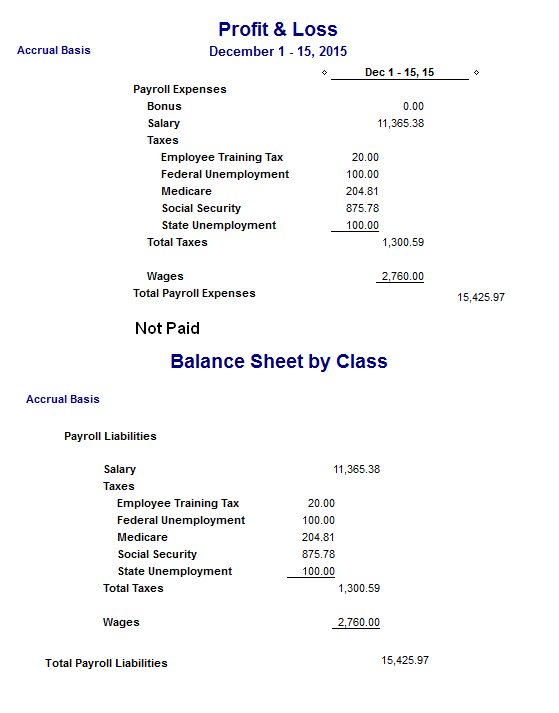

So in this journal entry total assets on the balance sheet decrease while the total expenses on the income statement increase. Presentation of Supplies on Hand. But because this involves accounting there are exceptions to that rule.

Best Cleaning Supplies Cleaning Materials Cleaning Guides Cleaning Hacks. Non-current assets are assets that cannot be easily and readily converted into cash and cash equivalents. Office Supplies With ongoing industry consolidation and the migration of sales to direct channels the office supply sector is one of the most challenged within the retail industry.

Office supplies purchased for significant amounts should be recorded as current assets rather than a direct expense. If youre a homeowner looking for ways to better clean your home or an office manager aiming to declutter your office we have something for you. Its important to correctly classify your office expenses supplies and equipment to make things easier for tax time.

The cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as Supplies or Supplies on Hand. Any property that is convertible to cash that a business owns is considered an asset. While they certainly fall into the asset category which is anything of value that you own office supplies are purchased for consumption making them more of a business expense than a current asset.

Since refrigerators have a useful life that is more than a year you may include it under Furniture Fixtures and Equipments as long as it is categorized to a Fixed Asset account type. Standard Unity Asset Store EULA. The cost of the office supplies used up during the accounting period should be recorded in the income statement account Supplies Expense.

How to Classify Office Supplies on Financial Statements. Fixed or Non-Current Assets. The third large office equipment or furniture should each be classified as a fixed asset to be depreciated over time.

On the other hand Office Supplies are normally used for tracking Day-to-Day. During the accounting period office supplies were purchased on account for5400. The office supplies account is an asset account in which its normal balance is on the debit side.

This is because their cost is so low that it is not worth expending the effort to track them as an asset for a prolonged period of time. Keeping Records to Prove Deductions. The business can then record an expense as and when these supplies are consumed.

The asset account Office Supplies had a beginning balance of5800. Pens and pencils. Supplies are usually charged to expense when they are acquired.

The cost of the office supplies used up during the accounting period should be recorded in the income statement account Supplies Expense. The cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as Supplies or Supplies on Hand. A physical count on the last day of the accounting period shows 2500 of office supplies on hand.

3300 8700 2900 5400. Your office expenses can be separated into two groups - office supplies and office expenses. Examples of Office Supplies.

When there is an exception it would likely fall into the office expense or office equipment category. If any office supplies expenses or equipment cost over 2500 these become depreciable assets and you must depreciate these assets spread the cost out over time. What is the amount of Supplies Expense for the accounting period.

To be classified as a current asset. 16 743 users have favourite this asset. November 04 2021.

When supplies are purchased the amount will be debited to Supplies. If the decision is made to track supplies as an asset then they are usually classified as a current asset.

Are Office Supplies Categorised As Assets Or Expenses Youtube

Solved Current Assets Cash Accounts Receivable Less Chegg Com

Office Supplies Are They An Asset Or An Expense The Blueprint

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current Noncurrent Assets Differences Explained

Chapter 9 2 Double Entry Accounting Accounting Debits Credits

Are Office Supplies A Current Asset Finance Strategists

Office Expenses Vs Supplies What S The Difference Quill Com Blog

Office Expenses Vs Supplies What S The Difference Quill Com Blog

0 comments

Post a Comment